How Retirement Age Changes in the USA Impact Your Future?

The retirement age in the USA is evolving. With important changes taking effect in 2025, many workers are faced with new rules for Social Security benefits. These updates may affect when you can retire and how much you’ll receive. Understanding these changes is crucial for preparing your future and ensuring financial security. Let’s discuss how changes impact retirement, and how you can adjust your retirement plans.

What Is the Current Retirement Age in the USA?

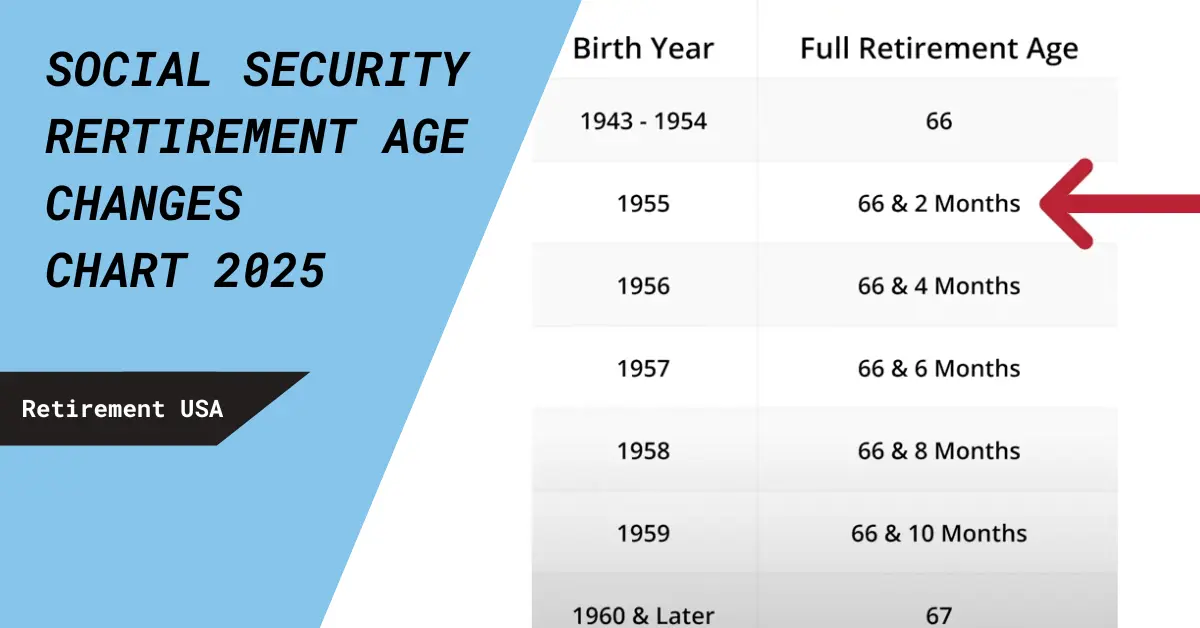

In 2025 standard retirement age in the U.S. is 66 or 67, depending on your birth year. People born in 1960 or later have a full retirement age of 67, meaning this is when they can begin collecting full Social Security benefits. While early retirement is possible at 62, it comes with a permanent reduction in monthly benefits. So After retirement you’ll start getting pension from Governments for your future.

Changes Starting in April 2025: What’s Changing?

Starting in April 2025, people born after 1960 will face a higher retirement age. The full retirement age will rise to 67, a change that affects millions of future retirees. These shifts are designed to ensure that Social Security remains financially sustainable as life expectancy increases.

Why Is the Retirement Age Increasing?

The primary reason behind these changes is the increased life expectancy of Americans. As people live longer, they collect Social Security benefits for more years. In 1940, the average life expectancy was 63; today, it’s over 78. As more people rely on Social Security for extended periods, the system needs adjustments to maintain its financial viability. Additional reasons for these changes include:

What Does This Mean for You?

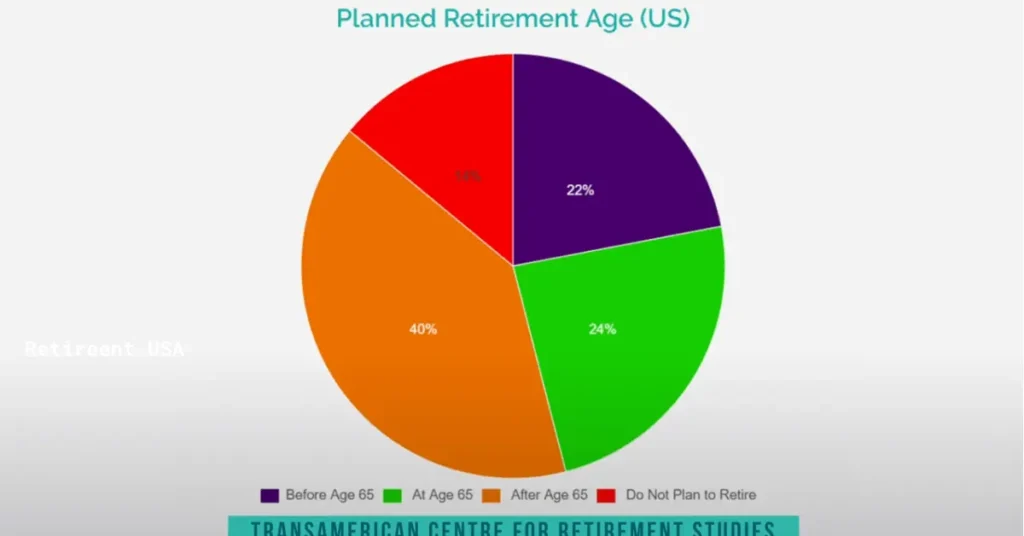

As retirement ages rise, the effect on your future benefits depends on your birth year and retirement plans. For those born after 1960, the full retirement age will be 67. If you’re already older, you may not be directly affected. However, it’s important to adjust your retirement expectations and savings plans accordingly. Key points to consider:

Social Security: Full Benefits and the New Retirement Age

Understanding how the new retirement age affects your Social Security benefits is essential for planning. Here’s how full benefits work:

When you claim benefits before your full retirement age, your monthly payments are reduced. This is something to consider when planning for early retirement.

Planning Your Retirement Around These Changes

These changes may require you to adjust your financial strategy. If you are still many years away from retirement, the best option is to start saving early. Consider these steps to ensure a stable retirement:

It’s also essential to regularly evaluate your retirement goals. Life circumstances change, and your savings strategy should reflect those changes to ensure long-term success.

Can You Retire Earlier Than the Full Retirement Age?

Though you can retire as early as 62, this decision comes with consequences. Your Social Security benefits will be permanently reduced, which could create financial strain later in life. However, for some people, retiring early is the right choice for health reasons or personal preferences. Here’s a quick breakdown:

Social Security Planning: Key Considerations

Proper Social Security planning is vital for a smooth retirement. Here are some things to keep in mind:

With effective planning, you can decide when to claim Social Security in a way that complements your overall retirement strategy.

Will the Retirement Age Keep Rising?

There are concerns that the retirement age may continue to rise in the future. Though there are no immediate plans to raise the retirement age beyond 67, it’s possible that further adjustments could happen. As life expectancy increases and the ratio of workers to retirees changes, lawmakers may decide to increase the retirement age again.

Conclusion

The future of retirement in the U.S. is shifting. The changes to the retirement age beginning in 2025 will affect how soon you can begin claiming full Social Security benefits. Whether you plan to retire early, at full retirement age, or later, it’s important to adjust your plans to maximize your benefits.